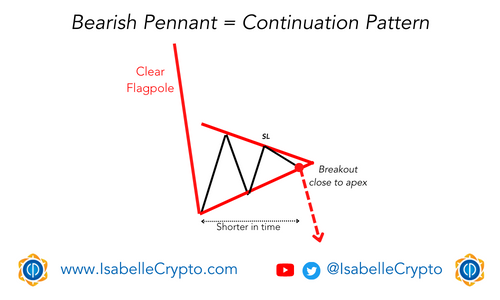

A bearish pennant is a chart pattern in technical analysis that appears on price charts of financial assets like cryptocurrencies. It is a bearish continuation pattern that is formed by a small symmetrical triangle, called the pennant, that is preceded by a sharp downward price movement, known as the flagpole.

The pennant is characterized by two converging trendlines, with the upper trendline acting as a resistance level and the lower trendline acting as a support level. The volume typically decreases as the price consolidates within the pennant, indicating a lack of buying interest.

The bearish pennant pattern is considered a bearish continuation pattern because it suggests that the bears are regaining control and are preparing to push the price lower. Traders typically look for a breakout below the lower trendline as a signal to sell their cryptocurrency coin, with a price target set at a distance equal to the height of the flagpole subtracted from the breakout price.

As with all chart patterns, the bearish pennant is not 100% guaranteed to work. Traders should always use other indicators and risk management techniques to minimize potential losses.