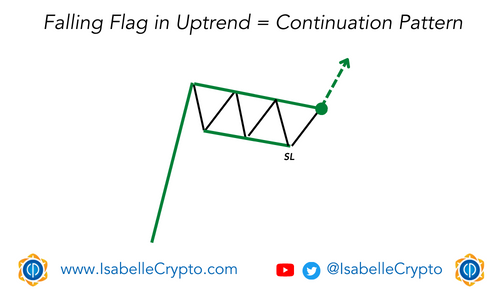

A Falling Flag Pattern or a “Bull Flag”, is a short-term continuation pattern that occurs within an uptrend. It is formed when the price of an asset consolidates in a downward sloping channel or flag after a sharp uptrend (= the flag pole), before resuming the original uptrend.

The falling flag pattern is characterized by a downward sloping channel, which forms as the price of the asset retraces a portion of the gains made during the initial uptrend. The channel is typically formed by two parallel trend lines, with the upper trend line acting as resistance and the lower trend line acting as support.

As the price of the asset continues to move within the falling flag pattern, traders look for a breakout above the upper trend line as a signal that the uptrend is resuming. This breakout is often accompanied by high volume, indicating strong buying pressure.

In summary, a falling flag or bull flag pattern is a bullish continuation pattern that occurs within an uptrend, and it represents a temporary pause or consolidation before the uptrend resumes.

However, it’s important to note that not all bull flag patterns result in a continuation of the uptrend, so traders should always use other indicators and analysis tools to confirm their trading decisions.