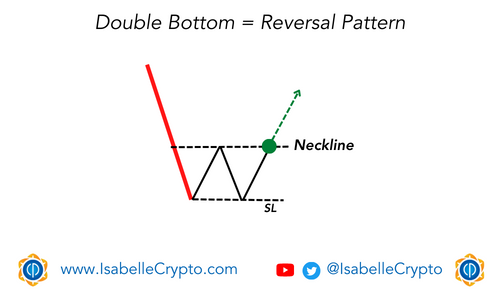

The double bottom reversal pattern is a common chart pattern used in technical analysis to identify potential trend reversals in cryptocurrencies. It is a bullish pattern that forms after a downtrend, indicating that the price of the cryptocurrency may be reversing and heading higher.

The double bottom pattern consists of two distinct lows that are separated by a peak, forming the shape of the letter “W”. The first low represents the end of the downtrend, while the second low signals a potential trend reversal. The peak between the two lows is referred to as the “neckline“, and it serves as a resistance level that must be broken in order to confirm the pattern.

Once the price of the cryptocurrency breaks above the neckline, it is considered a buy signal, as it indicates that the buyers have gained control and are pushing the price higher. Traders often use the height of the pattern to estimate the potential price target for the cryptocurrency once it breaks above the neckline.

It is important to note that not all double bottom patterns are created equal, and traders should use other technical indicators and fundamental analysis to confirm the pattern before entering a trade. Additionally, like all technical analysis patterns, the double bottom reversal pattern is not always reliable and should be used in conjunction with other tools to make informed trading decisions.