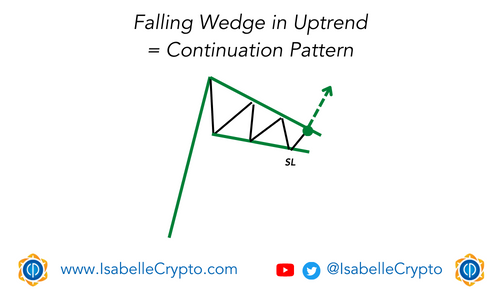

A falling wedge pattern in an uptrend is a technical analysis pattern that can occur in crypto or any other financial market. It is a bullish continuation pattern that is formed when the price of an asset moves lower within a narrowing range. The falling wedge pattern is characterized by a series of lower highs and lower lows that form a wedge shape, with the support and resistance lines converging towards each other.

In an uptrend, the falling wedge pattern may signal a potential continuation of the trend, as it shows that the selling pressure is decreasing and buyers are becoming more active. The narrowing range of the pattern indicates that the price is consolidating and that a breakout is likely to occur in the near future.

The breakout from the falling wedge pattern typically occurs when the price breaks through the upper resistance line, which confirms the bullish continuation signal. Traders often use this breakout as a buy signal, with the expectation that the price will continue to rise.

It’s important to note that while the falling wedge pattern can be a useful tool for technical analysis, it should not be relied upon exclusively when making trading decisions. Traders should always consider other factors, such as market trends, news events, and other technical indicators, before making any trades.