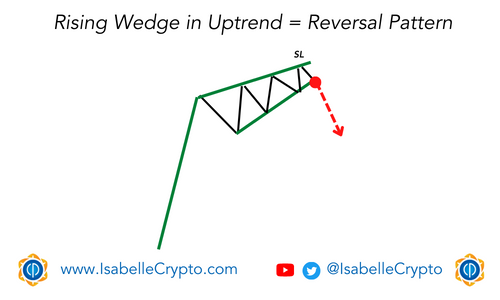

An ascending wedge, also known as a rising wedge, is a technical analysis pattern that can occur in an uptrend for cryptocurrency or any other asset. It is a bearish pattern that typically indicates a potential reversal of the current uptrend.

The ascending wedge is formed by two converging trend lines. The price of the cryptocurrency will typically make higher highs and higher lows within the pattern, creating a wedge shape.

This pattern is characterized by decreasing trading volumes, indicating that buyers are losing interest in the asset. As the price continues to climb within the wedge, it becomes increasingly overbought, and sellers start to enter the market, pushing the price down.

Once the price breaks below the lower trend line of the wedge, it typically triggers a strong sell-off, indicating a potential reversal in the uptrend. The price target for the ascending wedge pattern can be estimated by measuring the height of the wedge at its widest point and subtracting it from the point of the breakout.

Traders and investors use ascending wedge patterns to help them make decisions about when to buy or sell cryptocurrency. If the ascending wedge pattern is identified during an uptrend, it can be a bearish signal. Therefore, it may be a good time to sell or take a short position on the cryptocurrency.