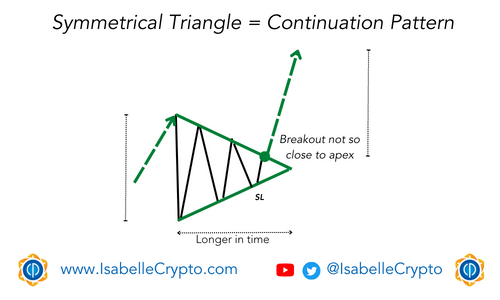

A symmetrical triangle is a technical chart pattern that forms when a cryptocurrency’s price consolidates within a triangular shape, with both the support and resistance lines converging toward each other. The pattern typically signals indecision among traders about the direction of the asset’s price.

In an uptrend, a symmetrical triangle pattern forms when the price of an asset creates higher lows and lower highs.

As the price consolidates within the triangle, traders may interpret this as a temporary pause or a potential reversal of the trend. However, if the price breaks above the upper resistance line of the triangle, it is considered a bullish signal, suggesting that the uptrend is likely to continue. Conversely, a breakdown below the lower support line may signal a potential reversal or trend reversal to the downside.

Overall, a symmetrical triangle in an uptrend suggests a period of consolidation and indecision among traders, with the potential for a breakout in either direction. However, in the context of an uptrend, a breakout above the upper resistance line is the more likely outcome.